In Massachusetts, the financial responsibilities of a divorce are typically shared between spouses. Both parties are responsible for their own legal fees unless the court orders otherwise. Assets and debts accumulated during the marriage are subject to equitable distribution, meaning they are divided fairly but not necessarily equally. Factors such as income, contributions to the marriage, and custody arrangements influence financial obligations.

Navigating Divorce Finances in Massachusetts:

A Guide for Affordable Legal Help

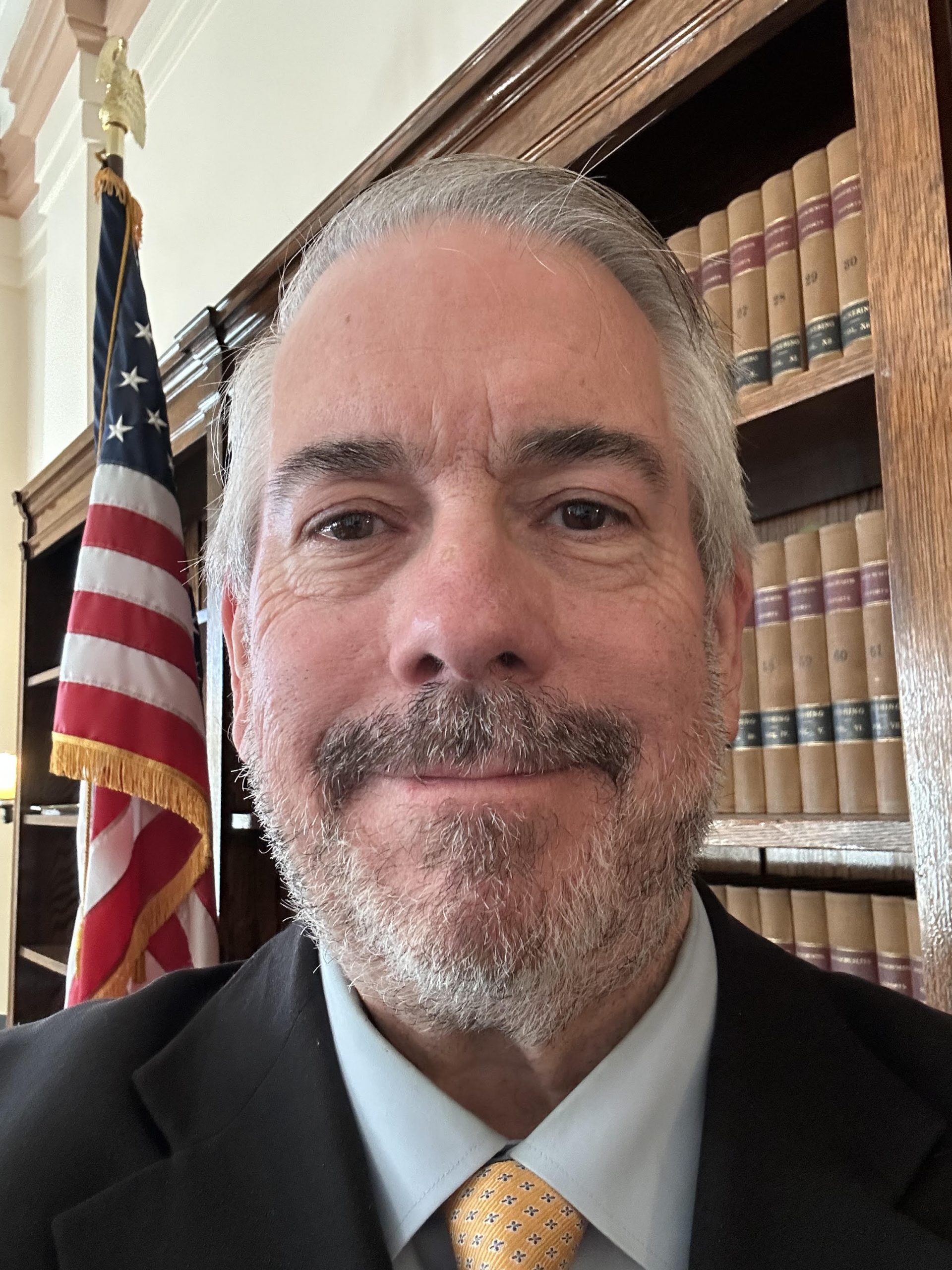

Divorce is not just an emotional process; it’s a financial one too. As you embark on this journey, it’s crucial to understand how finances will be managed. In Massachusetts, where divorce laws can be complex, having a grasp of your financial responsibilities is essential for a smoother process. As an experienced attorney providing affordable legal assistance, I’m here to guide you through the maze of financial obligations in divorce proceedings.

Who Pays for the Costs of Divorce?

In Massachusetts, the issue of who bears the financial burden of a divorce, including legal fees, is often a concern for individuals seeking to dissolve their marriage. Generally, each spouse is responsible for covering their own attorney fees and court costs unless the court orders otherwise. This means that you will likely need to pay for your own legal representation unless there are specific circumstances, such as a vast difference in financial resources between spouses, that warrant one party covering the other’s legal expenses.

Understanding the Legal Landscape:

Equitable Distribution in Massachusetts

Massachusetts follows the principle of equitable distribution when it comes to dividing marital assets and debts. Unlike community property states where assets are divided equally, equitable distribution means assets are divided fairly, but not necessarily equally. The court considers various factors to determine what is fair, including:

- the length of the marriage,

- each spouse’s contributions, and

- their financial needs post-divorce.

Financial Responsibilities During Divorce:

What You Need to Know

Divorce brings with it many financial responsibilities. From dividing property and assets to allocating debts, there’s much to consider. Marital property, which includes assets acquired during the marriage, as well as separate property are subject to division. This can include:

- homes, cars,

- bank accounts,

- retirement savings, and

- even business interests.

Debts accumulated during the marriage, such as:

- mortgages,

- loans, and

- credit card debt,

also need to be addressed.

Who Pays for What?

Navigating Financial Responsibilities

Determining who pays for what during a divorce can be contentious. Income, assets, and contributions to the marriage all play a role. Generally, each spouse is responsible for their own attorney’s fees, but there are exceptions, particularly in cases of significant income difference. Child support and alimony are additional financial responsibilities that may come into play, depending on the circumstances of the divorce.

Legal Options for Managing Financial Responsibilities: Finding Solutions

When it comes to managing financial responsibilities in divorce, there are several legal options available. Negotiation and mediation offer opportunities for spouses to reach agreements outside of court, reducing costs and minimizing conflict.

In cases where agreements cannot be reached, litigation may be necessary to resolve financial disputes. Each option has its benefits and drawbacks, and I can help you determine the best approach for your situation.

Special Considerations in Massachusetts:

Understanding State Laws

Massachusetts has its own unique laws and regulations governing divorce. Understanding these laws is crucial for navigating the process effectively.

For example, Massachusetts considers factors such as the contribution of each spouse to the marital estate and the needs of any dependent children when dividing assets. Staying informed about these special considerations can help ensure fair outcomes in your divorce proceedings.

Practical Tips for Managing Financial Responsibilities: Helpful Advice

Navigating divorce finances can feel overwhelming, but there are practical steps you can take to ease the process. Start by gathering all relevant financial documents, including:

- bank statements,

- tax returns, and

- property deeds.

If possible, open lines of communication with your spouse to discuss financial matters openly and honestly. Finally, seek guidance from a knowledgeable attorney who can provide personalized advice tailored to your unique circumstances.

Seeking Affordable Legal Help for Your Divorce

An affordable divorce is possible. At Afford Law, our fees are based on your income, so the less you earn, the less you pay. Our mission is to provide experienced legal help you can afford.

If you can’t afford our lower rates for a traditional attorney-client relationship, you have another option. Our legal coaching service can save you money and still give you access to a skilled attorney. In this arrangement, you represent yourself in court while we work with you behind the scenes to prepare you every step of the way. This service is available to you for one low monthly fee.

Legal Disclaimer

This article is intended for informational purposes only and does not constitute legal advice. Please consult with an attorney to discuss your specific circumstances and receive tailored guidance.

I have been practicing law in Massachusetts since 1995. My focus is in the areas of criminal and family law. I’m dedicated to providing high-quality legal help at an affordable price. I practice throughout Massachusetts. I earned my MBA from the University of Rhode Island in 2023. I earned my JD from New England School of Law in 1994. I earned my BA from Rhode Island College in 1990.