In Massachusetts, alimony calculations involve a comprehensive assessment of various factors. These factors include the income of each spouse, which encompasses not only their salaries but also bonuses, investments, and other financial resources. The court also takes into account the assets and liabilities of both spouses, ensuring that a fair distribution of financial resources is achieved.

Furthermore, the duration of the marriage plays a vital role in determining alimony eligibility and the length of any potential alimony awards. Longer marriages often result in more extended alimony awards, as the recipient spouse may have a more challenging time becoming self-sufficient.

Understanding Alimony in Massachusetts

Defining Alimony

Alimony, also known as spousal support, refers to the financial support one spouse provides to the other after a divorce or separation. Its primary purpose is to help the lower-earning or financially dependent spouse maintain a similar standard of living post-divorce.

Importance of Alimony

Alimony can have a significant impact on the financial stability of both spouses post-divorce, making it essential to understand the various types and how they apply to your situation.

Seeking Affordable

Legal Guidance

An affordable divorce is possible. At Afford Law, our fees are based on your income, so the less you earn, the less you pay. Our mission is to provide experienced legal help you can afford.

If you can’t afford our lower rates for a traditional attorney-client relationship, you have another option. Our legal coaching service can save you money and still give you access to a skilled attorney. In this arrangement, you represent yourself in court while we work with you behind the scenes to prepare you every step of the way. This service is available to you for one low monthly fee.

Eligibility for Alimony

Factors in Alimony Decisions

To determine eligibility for alimony, Massachusetts courts consider factors such as:

- the length of the marriage,

- the financial need of the recipient spouse,

- the financial ability of the paying spouse, and

- the contributions of each spouse during the marriage.

Calculating Alimony in Massachusetts:

The Alimony Formula

Massachusetts doesn’t have a formula for calculating alimony. The court makes it’s decision based on factors such as

- the income of each spouse,

- their assets and liabilities,

- future earning potential, and

- their health and age.

Income of Each Spouse

The court assesses the income of both spouses, including not only salaries but also bonuses, investments, and other financial resources. The court needs to get a complete picture of both spouse’s financial situation.

Assets and Liabilities

Assets and liabilities of both spouses are considered to ensure a fair distribution of financial resources. A spouse with significantly more assets needs less financial help from the other.

Modifications and Termination of Alimony:

Changing Circumstances

Alimony orders can be modified or terminated if there are significant changes in circumstances, such as:

- a change in income,

- remarriage of the recipient spouse, or

- retirement of the paying spouse.

Legal Process

To request a modification or termination of alimony, a legal process must be followed, involving the court’s approval. We must first show that a material change in circumstances has taken place. Then we have to convince the judge that the change is fair to all concerned.

Tax Implications

Tax Consequences

Understanding the tax implications of alimony payments is essential. For divorces finalized after December 31, 2018, alimony is no longer tax-deductible for the payer or considered taxable income for the recipient.

Consult a Tax Professional

To fully understand the tax implications of alimony in your specific situation, consult a tax professional. As with any tax situation, alimony can be very complicated. It’s best to talk to someone who knows.

Negotiating Alimony Agreements:

Alternative to Court

In some cases, spouses can negotiate alimony agreements outside of court through mediation or collaboration. This can save you time, money and stress. Keep in mind, whatever agreement you reach still has to be approved by the judge.

Benefits of Agreement

Negotiating an agreement can lead to more flexible and mutually acceptable terms, potentially reducing legal expenses and emotional stress. It also gives you more control over the outcome.

Conclusion

In conclusion, understanding how alimony is calculated in Massachusetts is crucial when navigating divorce proceedings. It involves various factors, including the type of alimony, eligibility criteria, and a detailed assessment of financial circumstances. If you need affordable legal assistance in matters of alimony, our experienced team is here to guide you through the process and ensure your rights are protected.

Legal Disclaimer

This article is intended for informational purposes only and does not constitute legal advice. Please consult with an attorney to discuss your specific circumstances and receive tailored guidance.

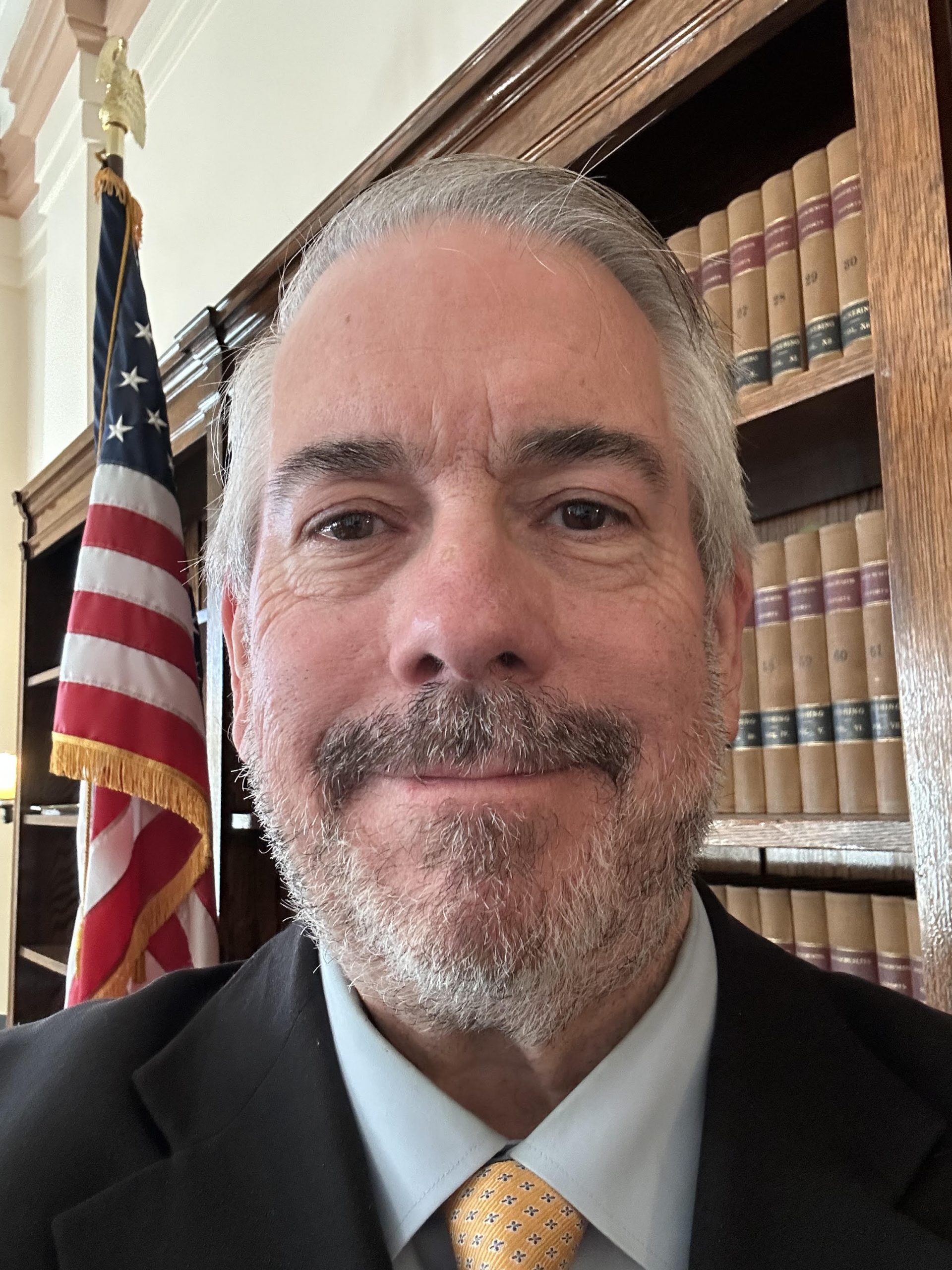

I have been practicing law in Massachusetts since 1995. My focus is in the areas of criminal and family law. I’m dedicated to providing high-quality legal help at an affordable price. I practice throughout Massachusetts. I earned my MBA from the University of Rhode Island in 2023. I earned my JD from New England School of Law in 1994. I earned my BA from Rhode Island College in 1990.